What Is Risk Adjustment?

Risk adjustment is a methodology that equates the health status of a person to a number, called a risk score, to predict healthcare costs. The “risk” to a health plan insuring members with expected high healthcare use is “adjusted” by also insuring members with anticipated lower healthcare costs.

While most medical coders are familiar with the fee-for-service (FFS) payment methodology in which insurers pay providers based on the procedures or services performed for a patient, risk adjustment is instead how insurance companies participating in specific programs get payment for managing the healthcare needs of members based on their diagnoses.

Risk adjustment is critical to ensuring adequate compensation to health insurance plans, so they maintain coverage and access to care for beneficiaries likely to incur higher than average costs. Because risk adjustment programs are developed and managed by government agencies created to serve all eligible members of the public, a health insurance company cannot discriminate or purposely insure only a certain demographic of members with a limited range of expected healthcare costs. The case mix of both healthy and sicker patients, and the cost-sharing of expenses spread across all members, is designed to provide access to quality healthcare regardless of health status and history.

Providers have an important role to play in risk adjustment, too. An engaged partnership between the provider and the health plan is vital to bringing valuable benefits to enrollees. For instance, an insurer may use premiums and risk adjustment payments to offer its members enrollment in exercise programs, case or disease management, transportation to medical appointments, and other services. The health plan uses diagnosis codes that providers submit on claims to identify what types of programs are needed, and more specifically who needs them.

ed to predict current year healthcare costs. Therefore, information for risk adjustment relies solely on the medical record data submitted for reimbursement in the year it occurred.

The External Data Gathering Environment (EDGE) is a data collection service that insurers must use to submit enrollee information as well as medical and pharmaceutical claims. An EDGE server runs HHS-developed software designed to verify submitted data, execute risk adjustment processes, and generate summary reports for submission to HHS.

Medicaid Risk Adjustment

Medicaid Chronic Illness and Disability Payment System (CDPS) is the risk adjustment payment methodology states use for Medicaid beneficiaries who enroll in a Managed Care Organization (MCO). While each state has its own set of eligibility criteria, in general, Medicaid (the federal branch of CMS partnering with states) provides health coverage for qualified low-income families and children, pregnant women, the elderly, and people with disabilities. Medicaid beneficiaries may enroll or disenroll at any time. Applying for Medicaid can be done on the Marketplace exchange.

The Children’s Health Insurance Program (CHIP) is an insurance program that provides low-cost health coverage to children in families that earn too much to qualify for Medicaid but not enough to buy private insurance. Each state offers CHIP coverage, which works closely with the state Medicaid program according to federal requirements. Depending on the eligibility of the enrollee, CHIP may or may not fall under a risk adjustment payment model.

Medicaid risk adjustment identifies the demographics of an enrollee and uses different values of risk score calculation for disabled individuals, adults, and children. The Medicaid risk adjustment model is concurrent in that the current year’s diagnoses affect the current year’s risk score.

Like all risk adjustment models, CDPS uses a crosswalk that assigns certain diagnosis codes to an HCC, which then is computed into a risk score. In the Medicaid risk adjustment payment model, conditions are weighted hierarchically within major condition category groups. For example, within the adult cardiovascular group, you may see information as shown in Table 2.

Table 2. Example of Medicaid Risk Adjustment Cardiovascular Group

| CDPS Category | Severity Rank | CDPS Level | CDPS Adult Group | Example Diagnosis | ICD-10-CM Code |

|---|---|---|---|---|---|

| Cardiovascular | 7 | Extra low | CAREL | Hypertension | I10 |

| Cardiovascular | 4 | Medium | CARM | Hypertensive heart disease with heart failure | I11.0 |

| Cardiovascular | 4 | Medium | CARM | Primary pulmonary hypertension | I27.0 |

In Table 2, the CDPS Adult Group shown in the fourth column is based on the category from the first column (cardiovascular) and the level of risk from the third column (extra low to extremely high), forming an abbreviation. For example, CAREL means the diagnosis hypertension falls into the cardiovascular (CAR) category with an extra low (EL) level of risk within the CDPS Adult Group.

This table also helps show hierarchy. Because both hypertensive heart disease with heart failure and primary pulmonary hypertension are in the medium level, the risk value assigned to those diagnoses is added to the patient’s risk score only once even if the patient has both conditions documented. If the patient also has the extra low condition (hypertension) reported, it is not calculated because the medium severity rank 4 trumps hypertension’s extra low severity rank 7. If a member has other diagnoses in a different CDPS Category, this additive, but hierarchical, payment system adds score values for those categories (not shown in this example).

In the CDPS model, a noticeable difference from other payment models is the inclusion of less common but costly conditions more prevalent among disabled Medicaid beneficiaries. Another difference is how prescription use affects a person’s risk score. MRX is a pharmacy-based program in the Medicaid risk adjustment payment model that uses National Drug Codes (NDCs) to assess risk. In the CDPS+Rx payment model, both diagnosis codes and NDCs combine to determine the patient’s risk score.

Medicare Risk Adjustment

Medicare risk adjustment is the most widely used risk adjustment model and is connected to Medicare Advantage Organizations.

A Medicare Advantage Organization (MAO, formerly known as Part C) is a health insurance plan contracting with CMS to offer Medicare beneficiaries insurance that incorporates institutional and outpatient services as well as optional prescription benefits.

Typically, a person who is 65 years or older is eligible for Medicare benefits, but disabled persons are also eligible regardless of age. A beneficiary can decide whether to enroll in traditional Medicare Parts A and B or with an MAO. There are various scenarios that will determine when a person can and should enroll.

Risk (RAF) score calculation: Medicare risk adjustment uses the CMS-HCC crosswalk to calculate a member’s annual risk score based on chronic and severe acute conditions that are expected to impact healthcare costs long term. The RxHCC crosswalk is used if the beneficiary is also enrolled in a Part D (prescription drug) plan.

Like in other risk adjustment models, each HCC is a collection of similar diagnoses in one payment group. For example, unspecified pulmonary hypertension (I27.20), chronic diastolic heart failure (I50.32), and dilated cardiomyopathy (I42.0) map to the same HCC 85 in the CMS-HCC model even though they are coded differently in ICD-10-CM. No matter how many of a patient’s ICD-10-CM codes map to a CMS-HCC, the risk value (factor) for that category is added only once to a patient’s risk score, as the HCC calculator tool in Figure 3 shows. The three example codes in the top Diagnoses section all map to HCC 85, but the Calculator Results at the bottom add the HCC 85 risk factor only once.

Figure 3. HCC Calculator Showing Multiple Diagnoses Mapping to a Single HCC

Hierarchy elimination: Another area to consider is that some CMS-HCCs belong to “families” that are subject to hierarchy elimination. If providers report multiple conditions that map to a family in a single calendar year for a patient, only the HCC representing the most severe condition is used for risk score calculation.

The fragment of a CMS-HCC hierarchy list in Table 3 will help demonstrate. If an ICD-10-CM code submitted for a patient during a calendar year maps to an HCC shown in the first column, and diseases were also reported for that patient in any HCC listed in the last column of the same row, then all the HCCs in the last column are dropped, or not used in HCC risk score calculation. Only the HCC in the first column is calculated. For instance, if HCC 8 applies to a patient, then Medicare will not use HCCs 9, 10, 11, and 12 in the risk score calculation.

Table 3. CMS-HCC Hierarchy List Showing Which Disease Groups Drop When Multiple HCCs Apply to a Patient

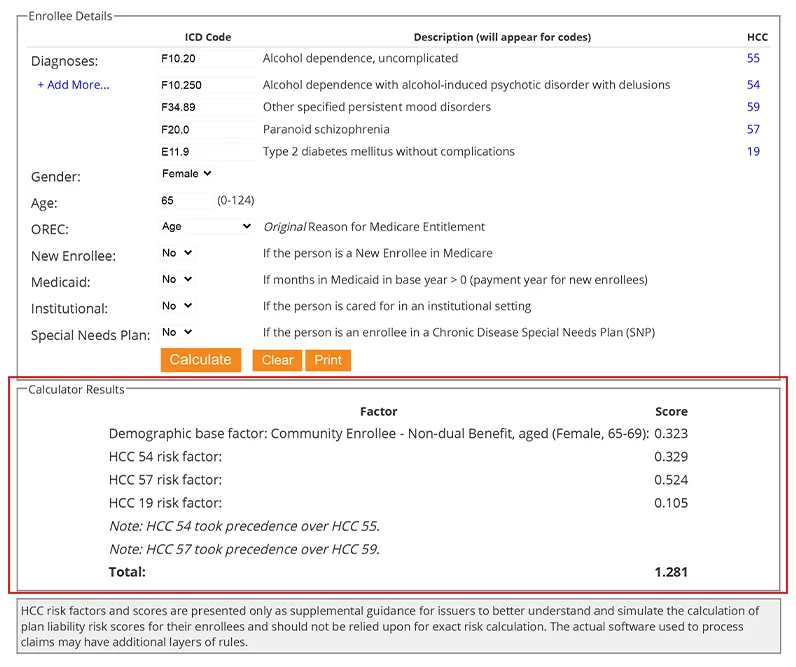

Also keep in mind that the CMS-HCC model is additive. If a provider submits other diagnoses outside of a family at any time in a calendar year, Medicare also uses those diagnoses when calculating the HCC risk score. For instance, note how the Calculator Results section in Figure 4 shows multiple HCC scores added together (for HCCs 54, 57, and 19) and also lists when an HCC is not used for calculation (for instance, the score for HCC 55 is not included because HCC 54 takes precedence).

Figure 4. Example of Additive CMS-HCC Model, Adding Multiple HCC Scores Together

While this information about hierarchies is interesting to risk adjustment coders, these calculations and hierarchy groupings are performed by CMS. Official risk scores are reported to the MAO, but the health plan may run their own analysis to aid in predicting costs. Risk adjustment coders will rarely need to perform these calculations, but seeing how risk scores are calculated is helpful to fully grasp the need for accurate and complete diagnosis reporting.

Diagnosis documentation: CMS has strict criteria concerning the medical record documentation used for risk score calculation. Only records signed by approved provider types for services performed in approved locations can be used for diagnosis validation. While any healthcare provider with a National Provider Identifier (NPI) may submit claims for payment of services (FFS), only face-to-face encounters with approved specialty types are acceptable for abstracting diagnosis codes for risk score calculation.

Payment: Medicare risk adjustment is considered a prospective model. The current year’s demographics and diagnoses predict the following year’s payments.

While MAOs receive a per-member per-month (PMPM) capitation payment based on predicted risk scores, final payment from CMS based on actual risk scores could take up to two years. For example, in Table 4, notice the final payment for 2021 dates of service (DOS) will not occur until after the final submission of diagnosis codes in 2023.

Table 4. Comparison of DOS and Payment Adjustment Year in Medicare Risk Adjustment

| DOS Period | Submission Date | Payment Adjustment Year |

|---|---|---|

| 01/01/2020 to 12/31/2020 | 01/31/2022-Final | 2022 |

| 01/01/2021 to 12/31/2021 | 03/04/2022-Interim | 2022 |

| 01/01/2021 to 12/31/2021 | 01/31/2023-Final | 2023 |

| 01/01/2022 to 12/31/2022 | 3/3/2023-Interim | 2023 |

| 01/01/2022 to 12/31/2022 | 01/31/2024-Final | 2024 |

Table 4 is not all-inclusive of submission dates, but it puts into perspective why accurate and complete diagnosis coding is so important at the provider claim level. In other words, diagnoses the health plan received on a claim in 2021 can help predict future costs for its members and, when submitted to CMS early, will affect the PMPM payment received in 2022. Just because the plan has until Jan. 31, 2023, to submit 2021 diagnoses to CMS for final payment, that does not mean the plan should wait until then. Funds received via premiums and risk adjustment payments are used for member benefits and programs; the earlier the plan receives the funds, the earlier benefits can be distributed.

Other Risk Adjustment Payment Models

In addition to the three major risk adjustment payment models already discussed, there are additional models that serve unique populations.

Programs of All-Inclusive Care for the Elderly (PACE)

PACE is a CMS program offered to people at least 55 years old who need nursing home care, but who live in a community with a PACE program as an alternative to being institutionalized. Following the CMS-HCC crosswalk, a frailty adjustment is added to the member’s demographic risk factor to offset additional healthcare expenditures.

End-Stage Renal Disease (ESRD)

The ESRD risk adjustment model follows the CMS-HCC model but includes additional conditions more likely to occur in a patient who is on dialysis or who has received a transplant. Medicare oversees the ESRD payment model.

Dual Eligible Special Needs Plans (D-SNPs)

Dual eligibility is a term used for beneficiaries who meet the age or disability requirement of Medicare but the financial criteria for Medicaid. They may choose to enroll for healthcare coverage with an MAO in a special plan called D-SNP. Risk scores are calculated based on the CMS-HCC crosswalk with a dual-eligibility adjustment to account for the special needs of enrollees in this type of plan.

Risk Adjustment Data Validation (RADV) Audit

A Risk Adjustment Data Validation (RADV) audit is an audit of insurance companies offering risk adjustment plans to members to ensure accuracy of the data submitted.

The Improper Payments Information Act of 2002, as amended by the Improper Payments Elimination and Recovery Act of 2010 (IPIA/IPERA), requires government agencies to identify, report, and reduce erroneous payments in the government’s programs and activities. A RADV audit is the process of verifying that codes submitted and used in risk score calculations are supported by medical record documentation.

CMS has created a checklist to help determine a record’s suitability for a RADV audit, such as confirming the date of service of the face-to-face visit and verifying the medical record is from an acceptable provider type with credentials in the signature. Each date of service is considered a stand-alone medical record.

Each risk adjustment model type has its own RADV process, but all have a similar flow, shown in Figure 5.

Figure 5. Sample RADV Flow

Remember that the risk adjustment contract is between the program agency (state or federal government) and the health plan. If payments based on diagnoses are not supported in a RADV, the program agency will recoup overpayments from the health plan, not the provider. Depending on the contract between the health plan and the provider, there may or may not be consequences to the provider based on a RADV audit result.

Below is an overview of how RADV audits work for different programs.

Commercial: The ACA requires states, or HHS on behalf of states, to validate statistically a sample of risk adjustment data each year. Called an HHS-RADV, this type divides the age groups and risk levels into 10 strata so that a true statistically random sample of enrollees is audited.

Table 5. HHS-RADV Divisions by Age and Risk

| HCC Stratum | Age | Risk Level | Stratum |

|---|---|---|---|

| 1 or More HCC(s) | |||

| Adult | Low | 1 | |

| Medium | 2 | ||

| High | 3 | ||

| Child | Low | 4 | |

| Medium | 5 | ||

| High | 6 | ||

| Infant | Low | 7 | |

| Medium | 8 | ||

| High | 9 | ||

| No HCC | All | N/A | 10 |

HHS-RADV audits typically take place six months after year-end, and all commercial risk adjustment health plans are required to be audited. An insurer may offer as many medical records as it deems fit to satisfy the audit request, but all claims for the dates of service provided must have been originally submitted on the EDGE server.

Medicaid: The Social Security Act, Section 1936, created the Medicaid Integrity Program (MIP) and directed CMS to conduct audits of any Medicaid provider, which includes managed care entities. Audit Medicaid Integrity Contractors (Audit MICs) are entities with which CMS has contracted to conduct post-payment audits. The Audit MICs share the results with CMS, who in turn shares the results with the applicable state. The states will pursue collection of any overpayment identified in the audit in accordance with state law.

Medicare: The Code of Federal Regulations (CFR), Title 42, outlines the principal set of rules and regulations regarding public health in the United States. Under this Title, CMS is required to adjust payments and report a payment error rate for MAOs.

CMS conducts two major RADV audits:

- Contract-Level: This process selects a stratified sample of enrollees per MAO contract based on low-, medium-, and high-risk classification. Conducted annually, the purpose is to establish an error rate of MAOs and conduct payment recovery for overpayments.

- National sample: Sometimes considered a “target sample,” this type of validation audit reviews MAOs who have certain outliers such as a large increase in risk scores from one year to the next.

The 21st Century Cures Act of 2016

Government legislation has addressed healthcare for the underprivileged population and specifically risk adjustment in various ways over the years. The 21st Century Cures Act (CCA) is one such law, as it relates to societal health including additional funding to the National Institutes of Health Innovation Projects, the Food and Drug Administration, HHS, and more.

Risk adjustment coders need to pay attention to how this act and other rulemaking affect Medicare risk adjustment. For instance, CMS has implemented variables that count conditions in the HCC adjustment model: When enrollees have four or more (up to 10) conditions mapping to a CMS-HCC, an adjustment value will be incrementally added to the risk score. The adjustment is meant to help MAOs with resources to better serve their sicker patients.

Also, as part of the goal to phase out using CMS’ Risk Adjustment Processing System (RAPS), explained more below, the CCA paved the way for CMS to begin using the Encounter Data System (EDS; also sometimes referred to as the Encounter Data Processing System or EDPS). In 2021, 75% of diagnosis data used for risk score calculation came from EDS, while 25% came from RAPS. In 2022 and beyond, EDS will be used entirely as the source of MAO diagnoses. The biggest difference between these systems is the data source.

Sources of Diagnosis Data for Risk Score Calculation

- Risk Adjustment Processing System (RAPS): MAOs submit data in five fields of the reporting system: date of service from, date of service to, provider type, diagnosis code, and patient identifier. This data is abstracted from claims submitted by providers, but also includes diagnoses captured during internal or vendor-contracted audits of medical records.

- Encounter Data System (EDS): A claim is sent from the provider to the MAO. The standard claims currently used are the CMS-1500 (paper claim) and the American National Standards Institute Accredited Standards Committee (ANSI ASC) X12N 837 version 5010A1 (electronic version). The insurance company forwards the claim to CMS.

With EDS, there is valid concern on the part of the MAOs about using only the diagnosis codes listed in the provider’s outpatient claim to calculate risk scores. Analysis and studies of claims are proving that providers’ claims do not list all applicable diagnoses. For this reason, MAO plans have increased their efforts to improve documentation practices of providers.

Last Reviewed on March 17, 2022, by AAPC Thought Leadership Team